What Is Business Strategy Analysis?

Business strategy analysis is the systematic review of the internal and external forces that shape a company’s ability to achieve its mission and objectives. By breaking down strengths, weaknesses, opportunities, and threats, you can pinpoint gaps, validate assumptions, and chart the most effective path forward.

Key Components of a Robust Strategy Analysis

1. Internal Factors – Strengths & Weaknesses

- Financial resources: Cash flow, credit lines, and profit margins.

- Human capital: Skills, experience, and leadership depth.

- Proprietary assets: Patents, trademarks, data, and technology.

- Operational capabilities: Production capacity, supply‑chain efficiency, and process automation.

Understanding these elements helps you see what sets your business apart and where you need to invest to close performance gaps.

2. External Factors – Opportunities & Threats

- Customer demand: Shifts in preferences, emerging needs, and willingness to pay.

- Competitive landscape: New entrants, substitute products, and rival capabilities.

- Regulatory environment: Compliance obligations, industry standards, and policy changes.

- Market trends: Technological disruption, macro‑economic shifts, and demographic changes.

External analysis tells you whether the market conditions support your strategic direction or require a pivot.

Step‑by‑Step Recipe for Conducting a Strategy Analysis

- Define the strategic goal: What specific outcome are you measuring (e.g., 15% revenue growth, market‑share expansion)?

- Gather data: Pull financial statements, sales dashboards, customer surveys, and competitor intel.

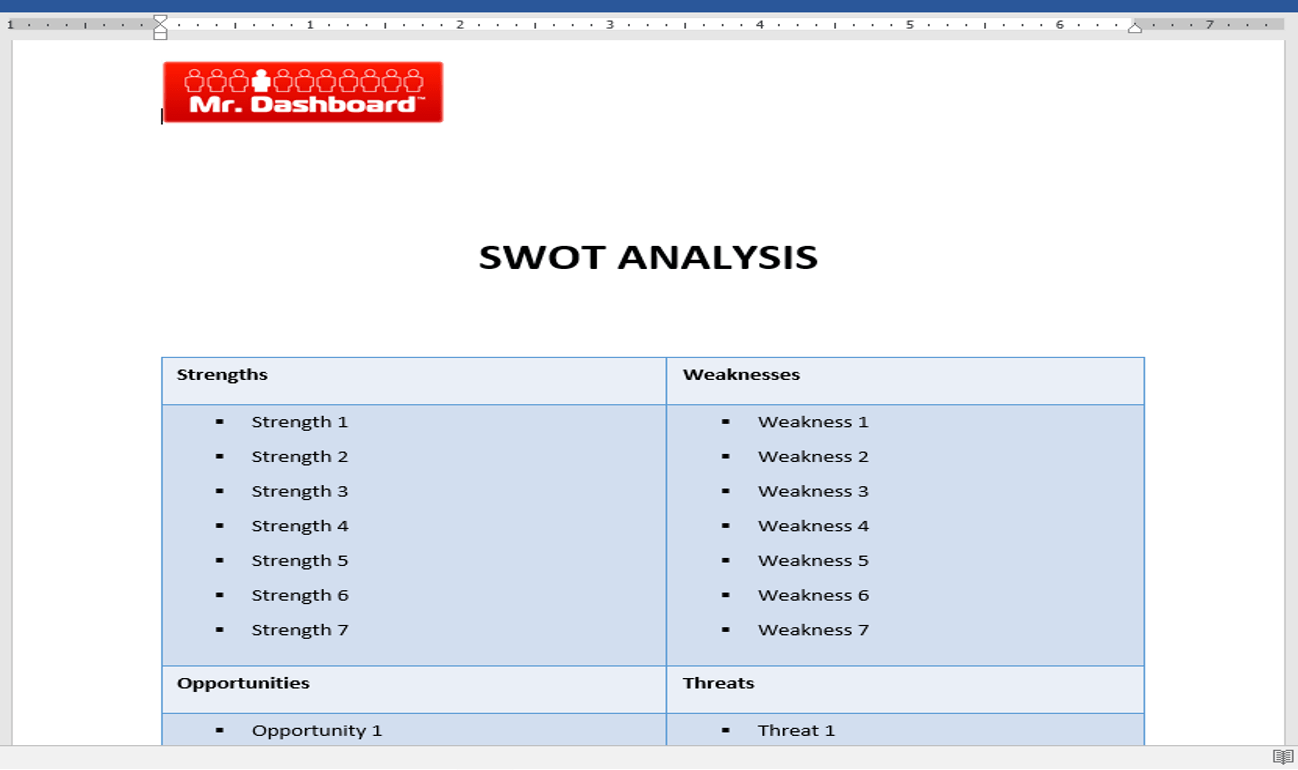

- Run a SWOT matrix: Populate internal strengths/weaknesses and external opportunities/threats.

- Score each factor: Use a 1‑5 rating to prioritize impact and likelihood.

- Identify gaps: Compare current performance against the strategic goal.

- Develop action items: Assign owners, timelines, and KPIs for each gap‑closing initiative.

- Validate with stakeholders: Review findings with leadership, sales, operations, and finance teams.

- Monitor & adjust: Set a quarterly review cadence to track progress and recalibrate.

Practical Tools to Speed Up the Process

- Download a ready‑made Business Plan Template to structure your objectives and assumptions.

- Use the Financial Statements Templates for accurate data gathering.

- Visualize performance with the Balanced Scorecard and Strategy Map Toolkit.

Industry‑Specific Quick Wins

Manufacturing

Check if production capacity meets forecasted demand, then align equipment maintenance schedules with quarterly sales targets.

Professional Services

Measure billable utilization rates and compare them against client acquisition costs to ensure profitability.

Retail & E‑commerce

Analyze cart‑abandonment rates alongside competitor pricing to uncover hidden revenue opportunities.

Strategy Analysis Checklist (HTML Table)

| Task | Owner | Due Date | Status |

|---|---|---|---|

| Define clear strategic objective | CEO | MM/DD/YYYY | Not started |

| Collect latest financial statements | CFO | MM/DD/YYYY | In progress |

| Run SWOT analysis workshop | Strategy Lead | MM/DD/YYYY | Pending |

| Score and prioritize gaps | Operations Manager | MM/DD/YYYY | Not started |

| Assign action items & KPIs | Department Heads | MM/DD/YYYY | Not started |

| Quarterly review & adjust | Executive Team | Every 3 months | Planned |

Next Steps

Now that you have a clear framework, it’s time to apply it to your business. Grab the Small Business Growth Strategy Pack for ready‑to‑use templates, KPI dashboards, and step‑by‑step guides that will accelerate your strategic planning and execution.